How To Get Rid Of Late Payments From Credit Report

Ask the lender to remove it with a goodwill adjustment letter. This is a straightforward way to get a late payment removed from your credit report.

Repair Your Credit Report With A Goodwill Letter Check Credit Score Credit Repair Credit Card Website

Unless youre a victim of fraud and or identity theft the only way to remove a recent late payment from the credit report is by getting the original creditor to agree to remove the late payment.

How to get rid of late payments from credit report. No matter how bad the situation is. Simply write another letter or even better get a customer service manager on the phone or via email or web engagement and ask that the company remove. You may be able to remove late payments on your credit reports and start to improve your credit with a goodwill letter A goodwill letter wont always work but some.

Another method of enhancing credit report is to pay costs on time. The credit report variety is in between 300-850 with most individuals falling in the category between 650-800. In the case of late payments that time limit is seven years from the date of delinquency.

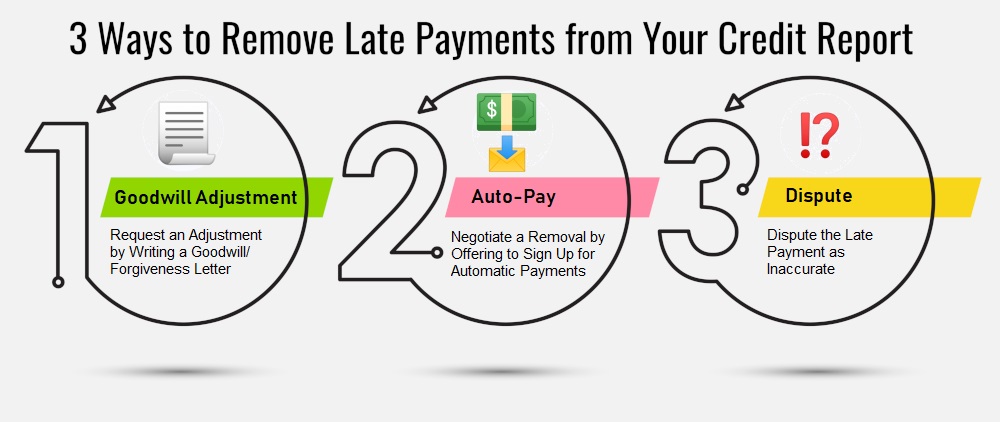

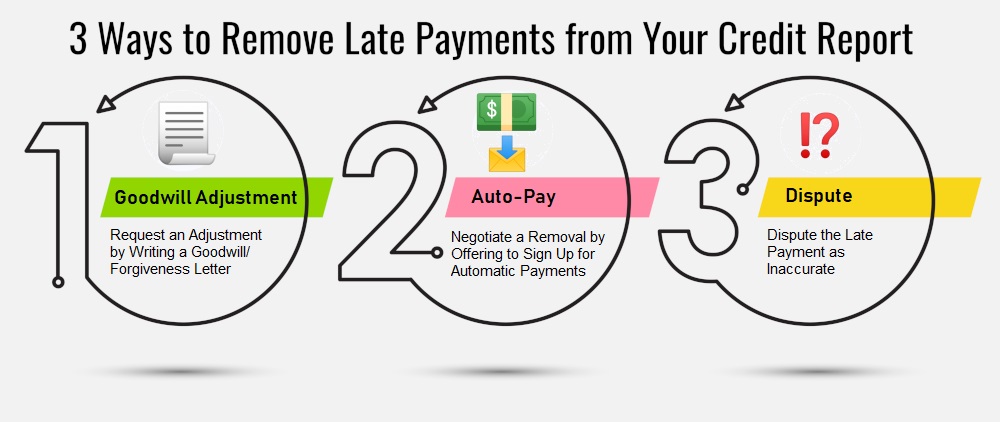

Three Ways You Can Remove Late Payments from your Credit Report 1. To be thorough it may also be a good idea to send a dispute to the credit bureaus yourself. Dispute the Late Payment with the Creditor Disputing a late payment with the bank or creditor directly is often the most effective.

A few of you might remember I posted a few days ago asking how can I get rid of a late payment reported on my credit My score went down almost 80 points with that one remark. You can request the change in two ways. Negotiate to Remove a Late Payment by Signing Up for Auto-Pay.

With that said the first step to trying to get these late payments removed is to write a goodwill letter which is basically just a letter where you contact them and ask them to be sympathetic or understanding to your cause and offer you a second-chance. Plead with creditors to delete late payments. A goodwill letter is a request made to your creditor to remove the report of the late payment from your credit report.

Request a Goodwill Adjustment from the Original Creditor. One possible solution. That should remove the information at the source so that it wont come back later.

If your missed payments are piling up you might think you waited too long to get a creditor to remove your missed payments. Request a Goodwill Adjustment from the Creditor. Dispute the Late Payment Entry on Your Credit Report as Inaccurate.

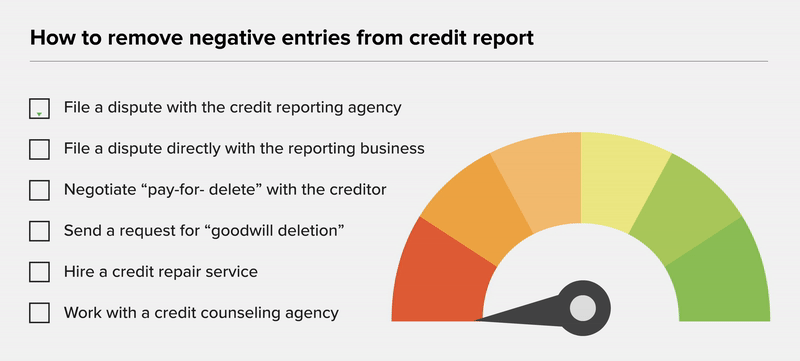

In some cases creditors are willing to make a goodwill adjustment if your payment history has been good or if you have a good relationship with them. There are many things that you can do to remove negative items and rebuild your credit. Get a written verification that the late payment was a reporting error by the lender and not your fault.

If outdated items dont automatically come off of your reports you can file a DIY dispute with the bureau and have it removed fairly quickly. How to Get Late Payments Removed. Seeing a credit report enables a person to see if there are any discrepancies that need to be corrected at the same time.

The good news is that the more time that passes your credit rating will start to improve. After the seven years have passed the late payment should come off of your credit report automatically. The simplest approach is to just ask your lender to take the late payment off your credit report.

Here are 3 proven ways to remove late payments from your credit report. Request a goodwill adjustment If youve been a loyal customer for many years and this is your first late payment your creditor may be willing to forgive your. Getting Late Payments Removed From Your Credit Report.

But like most of yall suggested I reached out to the office of ceo 2 times in last 2 weeks. And with a little time and effort you may be able to get late payments removed from your credit report entirely. Believe it or not your creditors can work with you.

Next you should request that the lender correct the mistake with the credit bureaus and ask for the late payment to be removed from your reports. Negative marks against your credit report can stick around for up to seven years but these simple requests can help keep your report spotless and your credit score healthy.

Remove Late Payments An Example Goodwill Letter For Credit Card Accounts Credit Card Credit Card Account How To Remove

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

How To Write A Goodwill Letter To Remove A Late Payment Nerdwallet

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

How To Remove Items From Your Credit Report In 2021 Money

How To Get A 700 Credit Score With Late Payments

4 Ways To Get Late Payments Removed From Your Credit Report Credit Repair My Credit Score How To Fix Credit

How To Remove Late Payments From Your Credit Report Improve Credit Score Improve Credit Credit Bureaus

Goodwill Letters A Note Can Get A Credit Blemish Wiped Away Creditcards Com

How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports Credit Karma

How To Remove Items From Your Credit Report In 2021 Money

How I Got 4 Late Payments Removed From My Credit Report In 30 Days

How I Got 4 Late Payments Removed From My Credit Report In 30 Days

How I Got 4 Late Payments Removed From My Credit Report In 30 Days

Diy Credir Repair Removing Late Payments Off Of Your Credit Report Flowchart Credit Repair Flow Chart How To Remove

Post a Comment for "How To Get Rid Of Late Payments From Credit Report"